Car Loan Rate Credit Score 650

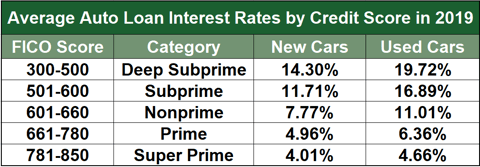

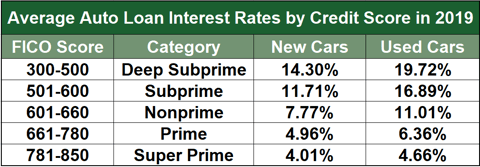

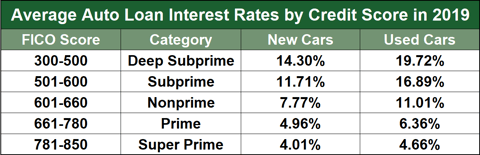

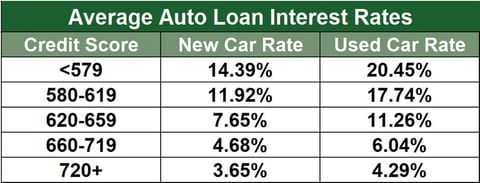

For someone with a credit score of roughly 650 the APR rates to expect would fall into the following ranges. On the FICO Score scale range of 300 to 850 higher scores indicate greater creditworthiness or stronger likelihood of repaying a loan.

What Credit Score Do You Need To Get A Car Loan

In order to avoid paying high interest you should make a large down payment.

Car loan rate credit score 650. A FICO score of 650 is considered to be fair but still it could be difficult to get approved for a car loan through conventional means. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms. 95 to 135 APR 48-Month New Car Loan.

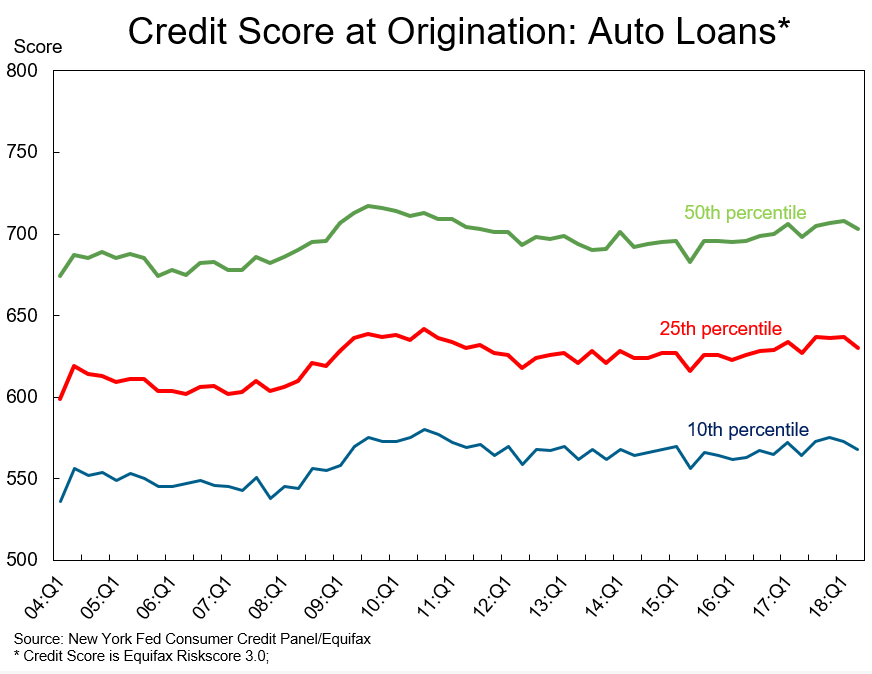

In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2 2020 Experian State of the Automotive Finance. 48-Month Used Car Loan. Interest rate on car loan with 650 credit score can go anywhere from 8 to 12 but it also depends on the lender and the specific background credit history that the person has that will determine what the interest rate is going to be.

A 650 credit score auto loan interest rate can vary based on the lender you choose down payment and even debt-to-income ratio. Thats because auto loans are secured loans meaning the vehicle you purchase will act as collateral. A higher credit score will mean a lower interest rate when buying a car used or new.

Luckily a credit score between 650 and 659 is considered a fair credit score and you should qualify for multiple low APR personal loan offers so long as your debt-to-income ratios are good. Because you are so close to receiving prime credit score rates it may make sense to consider spending 30 60. With your FICO score many lenders will consider your personal loan application under certain conditions.

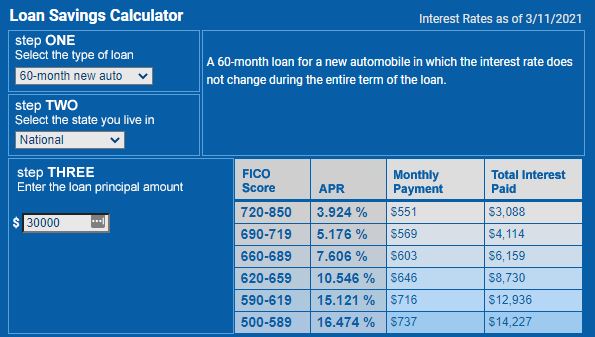

A FICO Score of 650 meets some lenders minimum requirements for a mortgage loanbut credit scores arent all mortgage lenders look for when deciding how much to lend you or what interest rates theyll charge. Individuals with a 620 FICO credit score pay a normal 94 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged 148 in interest over a similar term. With the higher credit score youll also save 7312 in interest paid over the life of the loan.

Happily a credit score in the 650 to 700 range will make qualifying for an auto loan relatively easy or at least significantly easier than it would be with a lower credit score. Having a 650 credit score your car lease may have higher interest rates. Your lender talked you into a 5000 down payment and applied an interest rate of eight percent over seven years.

The longer your term is the higher your rate will be. The longer your terms of the loan 36 to 60 months the higher your rates. Is 650 a Good Credit Score.

The commercials you see with low APR percentage rates are for attention grabbers and is most likely possible for borrowers with 750 or higher. Individuals with a 600 FICO credit score pay a normal 137 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged 148 in interest over a similar term. With a credit score of 650 you can find a car loan that offers 5 to 10 percent interest throughout the loans term.

Most lenders reward car buyers who put more money down by lowering the interest rate. With a credit score between 650 and 659 you are going to qualify for non-prime loans at a much higher interest rate than if you were able to increase your credit score to 700. You need a loan to buy a car but with fair credit generally a credit score between 630 and 689 you worry you wont qualify for a good interest rate.

A FICO score of. Your best bet is to work with non-conventional lenders that specialize in providing subprime 650 credit score auto loan with sustainable rates. Also loan terms either 36 48 or 60 month loans can affect your rate as well.

However if you can make timely payments every month your credit score will increase. A 650 Credit Score Car Loan Repayment Schedule Lets say you buy a 15000 auto with a 650 credit score. Buyers with a credit score of between 500-589 for example are looking at interest rates as high as 167 and a monthly car payment of 494.

With the interest rate as the only factor changed a person with a credit score in the highest category will pay 656 a month while a person with a score in the lowest category would pay 830 a. A 650 credit score auto loan interest rate will vary pending on your lender your downpayment your DTI and the loan terms. You might also be concerned that with a.

7 to 105 APR.

Car Loan Interest Rates In India 2019 Stats Facts Droom

Car Loan Interest Rates With 680 Credit Score In 2021

Bad Credit Car Loan Calculator

600 Credit Score Car Loans 2021 Badcredit Org

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

5 Online Car Loans For Fair Credit 2021 Badcredit Org

9 Easiest Auto Loans To Get 2021 Badcredit Org

Fico Credit Score Auto Loans Auto Financing Vehicle Apr

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

Bad Credit Car Loan Calculator

What Credit Score Do You Need For A Car Loan Creditrepair Com

Bad Credit Car Loan Calculator

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2021 Badcredit Org

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

650 Credit Score Auto Loan Interest Rate What Can You Expect Is 650 A Good Credit Score

What Is A Good Credit Score Credit Score Ranges Explained

600 Credit Score Car Loans 2021 Badcredit Org

What Credit Score Is Needed To Buy A Car Better Credit Blog

668 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Post a Comment for "Car Loan Rate Credit Score 650"